Modernize Compliance in Financial Services with CompliEase

Stay ahead of evolving regulations. Automate compliance processes, reduce risk, and secure audits across banking, insurance, wealth management, and fintech.

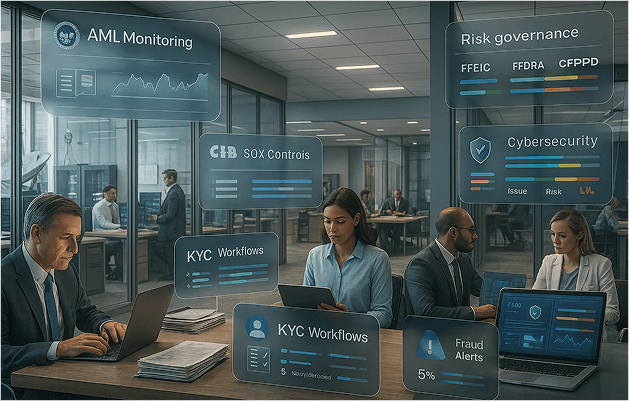

The Financial Services Industry Challenges

The financial services industry operates in one of the most highly regulated environments—spanning AML/KYC, SOX internal controls, data privacy and security laws, and cybersecurity obligations. With auditors and regulators such as SEC, FINRA, CFPB, FFIEC, and global data protection agencies, CompliEase helps organizations standardize compliance at scale.

Anti-money laundering (AML)

Know your customer (KYC) and due diligence

Sarbanes-Oxley (SOX) internal controls

Fraud detection and prevention

Risk governance and audit trails

Cybersecurity and data privacy (e.g., GLBA, GDPR, PCI-DSS)

Traditional compliance systems are manual, siloed, and reactive—creating operational inefficiencies, audit exposure, and legal risk.

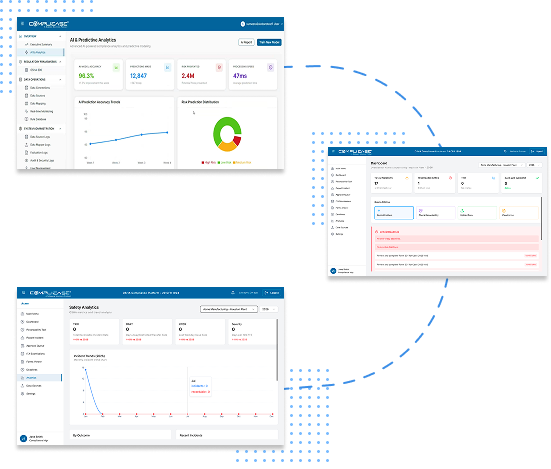

How CompliEase Solves It

Supported Financial Domains

Commercial & Retail Banking

Investment Banking & Wealth Management

Credit Unions & Mortgage Firms

Insurance (Life, Property, Auto, Health)

Fintech & RegTech companies

Why CompliEase for Financial Operations?

- 70% faster compliance reviews.

- Reduction in fines, audit penalties, and data breaches.

- Improved transparency and C-level visibility.

- Always audit-ready, always secure.

CompliEase ensures you’re not just checking boxes—you’re staying compliant, responsive, and competitive.

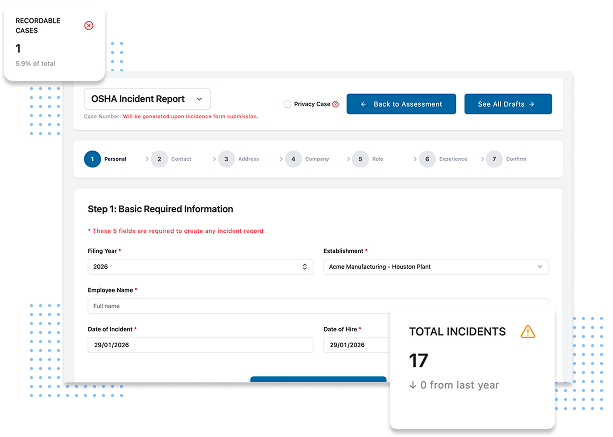

OSHA Recordability Assessment

Determine recordable incidents with clarity

CompliEase helps financial services organizations assess workplace incidents through a guided OSHA recordability process designed for office-based and operational environments. By capturing work activities, office locations, incident types, and injury outcomes, the platform ensures accurate OSHA 300 determinations while minimizing interpretation gaps across departments and sites.

-

Improve consistency in recordability decisions for office injuries, ergonomic incidents, and facility-related events.

-

Apply OSHA 29 CFR 1904 requirements through structured, rule-based assessments.

-

Maintain documented decision records to support OSHA inspections and compliance audits.

Centralized Incident Reporting

Capture workplace incidents with operational accuracy

From ergonomic strain and slip-related injuries to facility maintenance incidents and near-miss events, CompliEase enables financial services organizations to report and manage incidents through a centralized, end-to-end workflow. Incident data flows directly into OSHA 300 logs, ensuring accuracy, traceability, and compliance from initial reporting through final recordkeeping.

-

Standardize incident reporting across offices, branches, and operations centers.

-

Maintain secure, complete documentation supporting OSHA 300 and OSHA Form 301 requirements.

-

Streamline internal reviews and approvals with efficient workflows and reduced administrative effort.

Ready to transform Financial compliance into a competitive advantage?

Let CompliEase simplify the complex and secure your regulatory future.